-

- KR Hosts the 18th Meeting of the KR European Committee (KREC)

- KR Convenes Southeast Asia Committee and Technical Seminar

- MOU with Hyundai Mipo Dockyard for Joint Development of CSOV

- KR Collaborates with KHNP on Offshore Wind Power Development and Training Initiative

- KR Launches ‘SeaTrust-FOWT’ Solution

- KR Awarded SOF to EES’「EES CII Real-Time Analysis」

- Introducing the Latest Issue of "KR Decarbonization Magazine" - Summer 2023

- KR Honored with Ministry of Trade, Industry and Energy Award at World Accreditation Day 2023

- Contributing to Local Education: KR Donates 100 Million Won for School Development

- KR Hosts the 18th Meeting of the KR European Committee (KREC)

- KR Convenes Southeast Asia Committee and Technical Seminar

- MOU with Hyundai Mipo Dockyard for Joint Development of CSOV

- KR Collaborates with KHNP on Offshore Wind Power Development and Training Initiative

- KR Launches ‘SeaTrust-FOWT’ Solution

- KR Awarded SOF to EES’「EES CII Real-Time Analysis」

- Introducing the Latest Issue of "KR Decarbonization Magazine" - Summer 2023

- KR Honored with Ministry of Trade, Industry and Energy Award at World Accreditation Day 2023

- Contributing to Local Education: KR Donates 100 Million Won for School Development

-

- KR Hosts the 18th Meeting of the KR European Committee (KREC)

- KR Convenes Southeast Asia Committee and Technical Seminar

- MOU with Hyundai Mipo Dockyard for Joint Development of CSOV

- KR Collaborates with KHNP on Offshore Wind Power Development and Training Initiative

- KR Launches ‘SeaTrust-FOWT’ Solution

- KR Awarded SOF to EES’「EES CII Real-Time Analysis」

- Introducing the Latest Issue of "KR Decarbonization Magazine" - Summer 2023

- KR Honored with Ministry of Trade, Industry and Energy Award at World Accreditation Day 2023

- Contributing to Local Education: KR Donates 100 Million Won for School Development

KIM Minsung(Senior Surveyor) / Green Ship Technology Team

An increasing number of countries are adopting Carbon Dioxide Capture Utilization and Storage (CCUS) as a strategic means to achieve Nationally Determined Contributions (NDC) and carbon neutrality.

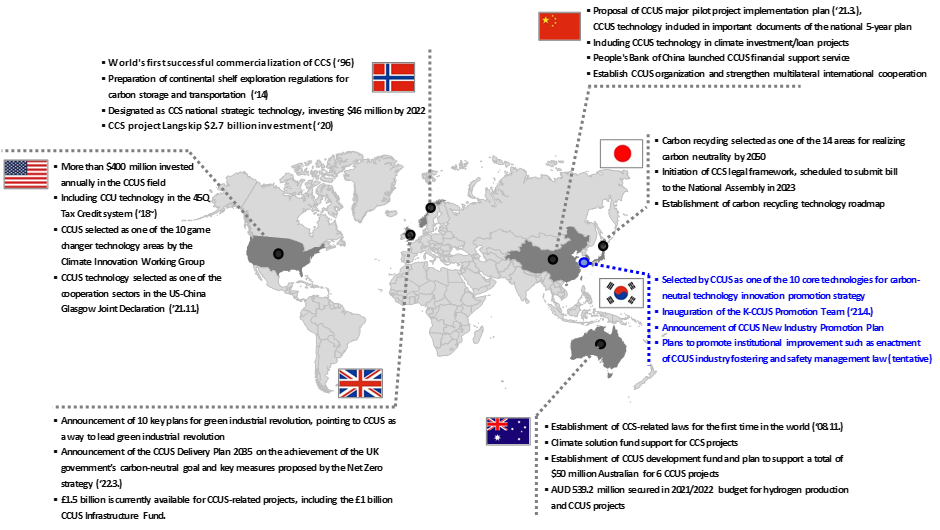

Major countries have introduced, and are implementing, various policies such as tax benefits, law revision, R&D investment, and international cooperation to commercialize CCUS technology and introduce it to the industry.

In the United States, an annual investment of over $400 million is channeled into CCUS technology. CCUS technology was also selected as the one of the fields of cooperation through the tax benefit system and the U.S.-China Joint Glasgow Declaration on Enhancing Climate Action. The EU plans to invest approximately $3.5 trillion in CCUS technology development, with plans to announce a strategic vision for CCUS technology in 2023. The Chinese government has attached great importance to CCUS as a policy, and has raised climate change policies to the same level as national development strategies. Japan also has selected carbon recycling as a means to achieve carbon neutrality and announced plans to create a CCS legal framework by 2030.

In Korea, comprehensive R&D policies are being formulated, including a CCU technology innovation roadmap, to achieve the carbon neutral scenario and CCUS policy goals outlined in the NDC.. In particular, through the 1st National Basic Plan for Carbon Neutrality and Green Growth (launched March 2023), the CCUS target was raised from 10.3 million tons to 11.2 million tons (Requirement of reduction to CO2 for CCS 4 million tons → 4.8 million tons, and CCU 6.3 million tons → 6.4 million tons, respectively). The amount of CO2 to be reduced annually through CCS in 2030 is 4.8 million tons, but the capacity of domestic storage is 400,000 tons/year (East Sea of Gas Field).About 4.4 million tons of CO2 needs to be stored overseas, so it is essential to develop a technology for CO2 carriers.

Figure 1. CCUS policies by major countries

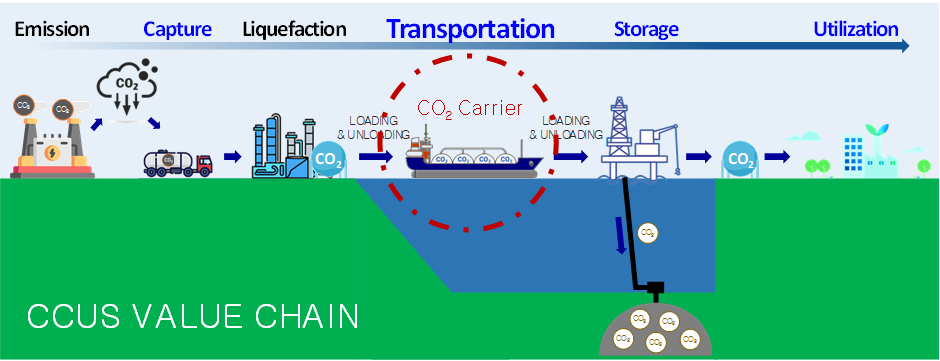

CCUS means carbon capture, utilization and storage, and the CCUS value chain is largely composed of “Carbon Capture → CO2 Transportation → CO2 Storage or Utilization”.

① Capture: Carbon capture technologies capture, absorb, or sequester CO2 through pre-combustion capture, oxy-fuel capture, or post-combustion capture.

② Transport: Once the CO2 is conditioned, it can be transported through pipelines, ships (CO2 carriers), motor carriers and railways to storage facilities or directly be utilized.

③ Storage: Instead of utilization, CO2 can be permanently stored through injection into wells, such as depleted oil or gas reservoirs, coal beds, or saline aquifers, or stored through mineral carbonation which creates a solid carbonate form. Sequestration in offshore depleted wells and sedimentary basins will require the shipping industry’s carrying capacity

④ Utilization: CO2 is currently being re-used as a key input in fertilizer, brewing, and food industries. However, there is ongoing research to support CO2 injection into wells to enhance oil recovery and for utilization in methanol production. Furthermore, a multitude of sectors, including chemical production, fuel manufacturing, construction materials, forestry, and bioenergy utilizing carbon capture, will rely on the supportive infrastructure facilitated by the shipping industry.

Figure 2. CCUS Value Chain

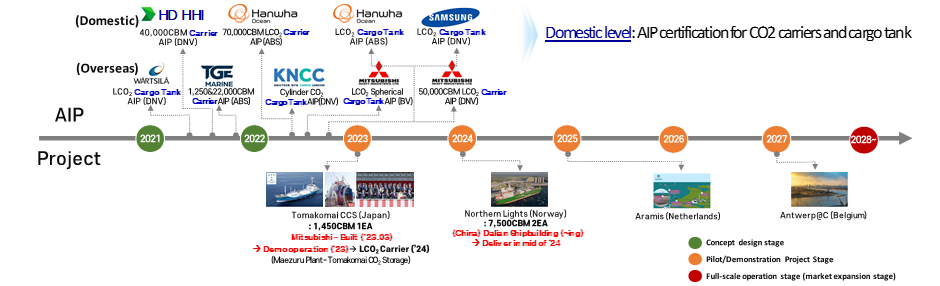

The CO2 carrier is a key strategic component in the CO2 transportation sector of the CCUS value chain, and it is a prerequisite for the realization and vitalization of the CCUS industry. In addition, the global market for CO2 carriers is expected to expand significantly. As a result of reviewing major buyers’ inquiries, it became clear that 「Size of Cargo Containment System → 40K or more」, 「Pressure condition → Low pressure」, 「Voyage Route → Ocean Voyage」, 「Re-liquefaction system → Required」, 「CO2 purity → High」 were identified as major requirements.. At present, commercialized CO2 carriers are limited to small-capacity food and beverage use, however, according to Clarksons Research, orders for CO2 carriers have been placed over the past two years ('21-'22), and recently (’23), with order inquiries on the rise for medium-sized CO2 carriers. The demand for CO2 carrier ships is expected to increase further, and as the market is expected to reach $250 trillion by 2050, it is necessary to develop core technologies for CO2 carriers to facilitate development of new markets.

As the industry’s interest in CO2 transport using ships increases, feasibility analysis and economic impact studies considering various conditions of CO2 transport by ship are being actively conducted. Norway, Japan, Belgium, and the Netherlands are promoting various projects using CO2 transport ships as a means of transporting CO2.

Figure 3. Overview of the Northern Lights project (Norway)

Major companies are obtaining AIP (Approval in Principle) for conceptual design of CO2 carriers and cargo containment systems from classification societies.. These companies include, Mitsubishi Shipbuilding (Japan), TGE Marine (Germany), KNCC (Norway), and Wärtsilä (Finland). In addition, as part of the Tomakomai CCS project, Japan's Mitsubishi Shipbuilding has completed the launch of a CO2 carrier of 1.45K ('23.03) and announced that it will conduct demonstration operations later this year. In addition, after successfully commercializing CCS for the first time in the world, Norway invested about $3.0 billion in the Long-Ship project, a CCS project in 2020, and requested Dalian Shipbuilding (China) to build two CO2 carriers of 7.5K. It plans to deliver two CO2 carriers in the middle of 2024. The three major shipbuilders in Korea are also acquiring AIP approval from DNV, ABS, and KR through the development of CO2 carriers and cargo containment systems, but plans to build and manufacture CO2 carriers have not yet been announced.

Figure 4. Status of CO2 carrier development and project promotion

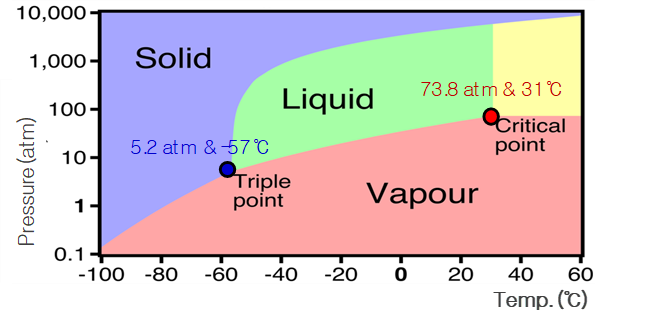

In order to achieve the 2030 NDC and goal for export industrialization and competitiveness enhancement, it is necessary to intensively nurture the transportation/storage sector. This represents the lowest technological level within the CCUS value chain. Core technologies to overcome the technological hurdles of CO2 carriers should be developed. The core technologies of CO2 carriers include cargo tanks, cargo management, loading and unloading, and cargo pumps/valves. Technology is especially needed to prevent CO2 from dropping below the triple point (5.2 atm and -57℃), where CO2 can exist in a liquid state under all operating conditions. Unlike other gases, CO2 has a critical point near normal temperature, and its triple point is not much higher than normal pressure, so it can easily change into three phases: gas, liquid, and solid, even with small external environmental changes. In addition, handling is not easy and technical difficulty is high. When CO2 converts from a gas (or liquid) to a solid during underground storage, there is a possibility ofsolidification problems occurring, such as the clogging of pipes.

Comparatively, the storage pressure conditions are relatively low when contrasted with other cargo containment systems. This indicates that the technology required for the storage container itself is not overly complex. However, the challenge of increasing tank size while maintaining operation pressures close to the triple point necessitates a reassessment during the development of cargo tanks, cargo management, loading and unloading mechanisms, and cargo pumps/valves. This endeavor can be perceived as the overarching objective in advancing core CO2 carrier technology.

Figure 5. Phase change of CO2 with pressure and temperature

The domestic technological prowess concerning the development of fundamental CO2 carrier technologies falls short in comparison to leading nations like Japan and Norway. Consequently, there is an urgent requirement for advancements in CO2 carrier technology in anticipation of the heightened demand expected by 2030. The Republic of Korea faces the challenge that design standards, encompassing storage capacity and voyage distances for CO2 carriers, have yet to be established. To propel the development of pivotal CO2-related technologies, effective communication with affiliated entities such as shipyards and equipment manufacturers is imperative.

Through this trajectory, the evolution of CO2 carrier technology enables major shipyards to conceptualize and construct these vessels, while domestic small and medium-sized equipment companies can not only establish an industrial ecosystem to support essential equipment, but also enhance the competitiveness of the Korean shipbuilding industry in the realm of CO2 carriers.