-

- KR Establishes Task Force to Support Arctic Shipping Route Project

- KR Hosts 20th European Committee Meeting in London

- KR Representative LEE Jungkun Elected Chair of IACS Safety Panel

- KR Hosts 6th K. LNG Owners Forum

- Publication of KR Technical Information Handbook on Fuel Cell Systems in Maritime Applications

- KR and ROK Naval Logistics Command Hold Seminar to Strengthen Quality Management of Naval Supplies

-

- New SOLAS regulation II-1/3-13 “Lifting appliances and Anchor handling winches” implemented on or after 1 January 2026

- Notice for Amendments to KR Classification Technical Rules(Rules & Guidance for Classification of Steel Ships Pt 7 / Pt 7 Ch.6 / Pt 8)

- Implementation of Biofouling Management Requirements for Ships Calling at or Operating in Brazilian Waters

- Notice for Amendments to KR Classification Technical Rules (Guidance for Freight Containers)

- Prohibition on the use and storage of fire-extinguishing media containing PFOS

- KR Establishes Task Force to Support Arctic Shipping Route Project

- KR Hosts 20th European Committee Meeting in London

- KR Representative LEE Jungkun Elected Chair of IACS Safety Panel

- KR Hosts 6th K. LNG Owners Forum

- Publication of KR Technical Information Handbook on Fuel Cell Systems in Maritime Applications

- KR and ROK Naval Logistics Command Hold Seminar to Strengthen Quality Management of Naval Supplies

- New SOLAS regulation II-1/3-13 “Lifting appliances and Anchor handling winches” implemented on or after 1 January 2026

- Notice for Amendments to KR Classification Technical Rules(Rules & Guidance for Classification of Steel Ships Pt 7 / Pt 7 Ch.6 / Pt 8)

- Implementation of Biofouling Management Requirements for Ships Calling at or Operating in Brazilian Waters

- Notice for Amendments to KR Classification Technical Rules (Guidance for Freight Containers)

- Prohibition on the use and storage of fire-extinguishing media containing PFOS

-

- KR Establishes Task Force to Support Arctic Shipping Route Project

- KR Hosts 20th European Committee Meeting in London

- KR Representative LEE Jungkun Elected Chair of IACS Safety Panel

- KR Hosts 6th K. LNG Owners Forum

- Publication of KR Technical Information Handbook on Fuel Cell Systems in Maritime Applications

- KR and ROK Naval Logistics Command Hold Seminar to Strengthen Quality Management of Naval Supplies

-

- New SOLAS regulation II-1/3-13 “Lifting appliances and Anchor handling winches” implemented on or after 1 January 2026

- Notice for Amendments to KR Classification Technical Rules(Rules & Guidance for Classification of Steel Ships Pt 7 / Pt 7 Ch.6 / Pt 8)

- Implementation of Biofouling Management Requirements for Ships Calling at or Operating in Brazilian Waters

- Notice for Amendments to KR Classification Technical Rules (Guidance for Freight Containers)

- Prohibition on the use and storage of fire-extinguishing media containing PFOS

KIM Minsung, Green Ship Technology Team

With the growing global emphasis on energy security and environmental regulations, the offshore plant industry is entering a new era of transition. Over the past decade, South Korea’s shipbuilding and offshore industry has faced a severe recession due to prolonged low oil prices and the COVID-19 pandemic. However, recent increases in international oil prices, combined with the implementation of carbon-reducing policies and eco-friendly vessel orders, present new opportunities for growth. In particular, the utilization rates of FPSOs (Floating Production, Storage and Offloading) and MOPUs (Mobile Offshore Production Units) have slightly increased, while Korea’s top three shipyards have already secured order backlogs exceeding three years, mainly for LNG carriers.

Nevertheless, this recovery is primarily benefiting major conglomerates, and small and medium-sized enterprises (SMEs), which lack sufficient capital and technological competitiveness, continue to face challenges in securing orders and managing operations. According to a 2021 survey by the Korea Small Shipbuilding Cooperative, 78.1% of SMEs identified “work support and fair pricing realization” as their most urgent policy need. Accordingly, SMEs are required to diversify into the offshore plant service sector, including dismantling, conversion, maintenance, and recycling, rather than remaining solely in construction.

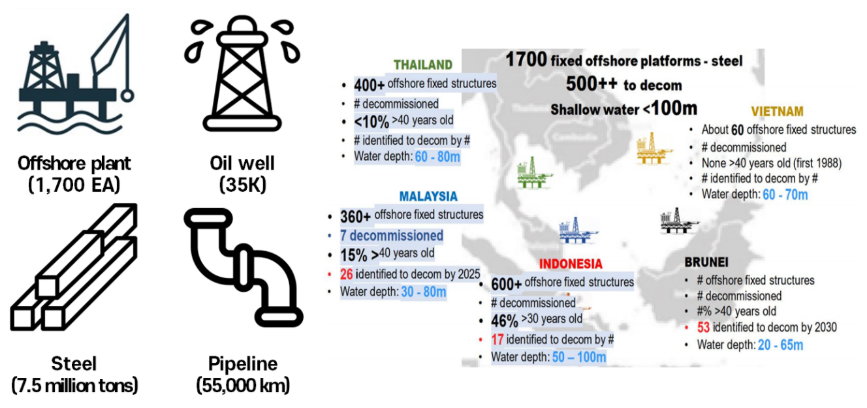

Meanwhile, international oil prices remain high at around USD 70 per barrel. Clarkson Research (UK) forecasts that investment in offshore plants will reach USD 123 billion in 2025, representing a ~50% increase compared to USD 81 billion in 2024, and indicating a sharp recovery from the 28% decrease recorded in the previous year relative to the 10-year average. In Southeast Asia alone, approximately 1,700 fixed offshore platforms installed between the 1980s and 1990s are currently in operation, and a dismantling/conversion market worth approximately KRW 9 trillion is expected to emerge within the next decade.

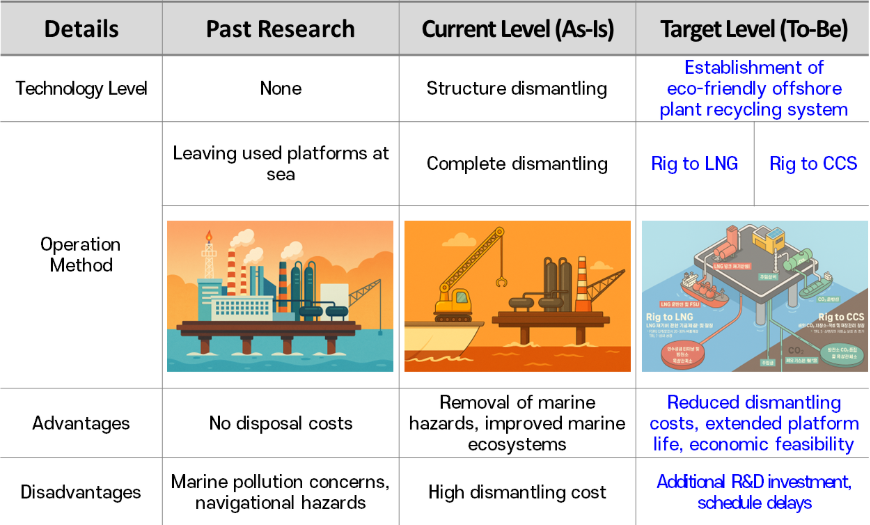

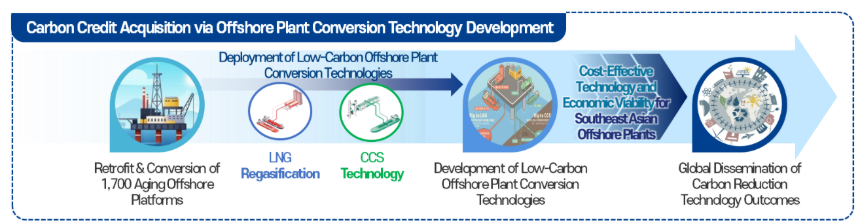

Previously, offshore plants were dismantled after reaching their end-of-life. However, under the global push for carbon neutrality and eco-friendly practices, alternatives such as converting offshore plants into LNG regasification facilities, CCS (Carbon Capture and Storage) plants, or smart aquaculture farms are actively being reviewed. These solutions are gaining attention as they can simultaneously achieve cost savings, environmental protection, and the creation of new industries.

Indonesia has faced project delays due to insufficient regulations on offshore plant dismantling and recycling. However, in cooperation with Korea’s Ministry of Oceans and Fisheries, Indonesia successfully completed its first offshore plant dismantling demonstration project in 2022. This achievement enabled Korean companies to secure follow-up dismantling contracts worth approximately KRW 43.2 billion (USD ~32 million), and the Indonesian government has since requested additional cooperation with Korea to develop CCS and LNG-linked offshore plant recycling technologies.

Furthermore, Indonesia is implementing policies to convert some of its 600+ aging offshore plants into CCS facilities, LNG regasification terminals, or smart aquaculture farms to achieve its national carbon reduction targets and reduce dismantling costs. Against this backdrop, Korea has a timely opportunity to enter the offshore plant conversion market, given its geographic proximity to Southeast Asia, its established government–industry cooperation networks, and its advanced shipbuilding and offshore engineering capabilities.

Figure 1. Offshore Platform Decommissioning Market Size in Asia-Pacific

This study aims to reduce carbon emissions by developing eco-friendly and economically viable methods for recycling or converting aging offshore plants, as well as to develop technologies for their transformation into LNG regasification and CCS (Carbon Capture and Storage) facilities. The goal is to create a new market for the offshore plant service industry, thereby enhancing the competitiveness of Korea’s offshore plant sector, facilitating the overseas expansion of SMEs and mid-sized companies, and contributing to national carbon neutrality objectives.

Table 1. Development of Low-Carbon Offshore Plant Conversion Technologies

Recently, there has been growing interest in developing technologies to convert offshore plants into LNG regasification terminals. Although there are no domestic cases of direct offshore plant conversion, Korean companies possess extensive experience in EPC (Engineering, Procurement, and Construction) projects involving the conversion of ships into FSRUs (Floating Storage and Regasification Units). For example, Samsung Heavy Industries has signed EPC contracts for the performance enhancement of FPSOs in Nigeria, while other Korean firms have successfully carried out FSRU conversion projects in Indonesia, Senegal, and the Philippines. Notably, KARMOL’s LNG-to-power project involved converting a Moss-type LNG carrier built in the 1990s into an FSRU, with Korean companies completing the design, regasification system EPC, integrated control, safety systems, instrumentation, and commissioning.

Project | Client | Country | Scope | Completion |

PLN - Pelindo Power Plant | JSK Shipping | Indonesia | FRU Conversion EPC | 2016 |

PLN - Pelindo Power Plant | PaxOcean | Indonesia | FSRU Conversion EPC | 2018 |

KARMOL’s LNG-to-power projects across geographies | KARMOL | Senegal Mozambique South Africa | LNGC to FSRU Conversion EPC | 2018 2019 2021 |

PH LNG Terminal | AG&P | Philippines | FSU Conversion EPC | 2022 |

Tamarananaya FPSO | Centrury group | Nigiria | FPSO Conversion & Upgrade | On-going |

Table 3. Status of Korean Companies’ Overseas CCS Projects

Company | Project | Location | Expected Storage (annual) | Start Year |

SK E&S | BU CCS etc | Australia, East Timor | 3 million tons | 2026 |

Samsung Engineering et al. | Shepherd | Malaysia | 2 million tons | 2027 |

GS Caltex | Yeosu Hydrogen Hub CCUS Cluster | Australia | 1.1 million tons | 2030 |

POSCO International | Petronas J/S etc | Malaysia | 1 million tons | 2030 |

(Source: Current Status & Challenges of CCUS in Korea, KCCI, 2023)

To convert offshore plants into LNG regasification terminals, a range of processes is required, including conversion design, LNG process design, bunkering system construction, storage tank and BOG (Boil-Off Gas) system fabrication, partial structural dismantling, and equipment installation. Korea’s top three shipyards, along with KOGAS (Korea Gas Corporation) and Korea Gas Technology Corporation, possess the necessary LNG process and engineering technologies; however, optimal designs, including assessments for pipeline reuse, are essential. Internationally, New Fortress Energy (NFE)’s FAST LNG project demonstrated the conversion of offshore plants into LNG liquefaction plants, halving construction time and reducing investment costs, thus highlighting the importance of such technologies.

Figure 2. Development of LNG and CCS Technologies for Low-Carbon Offshore Plant Conversion

This study is expected to generate annual export benefits exceeding USD 100 million, laying the foundation for Korean companies to enter the Asia-Pacific offshore plant conversion market. By integrating the LNG, CCS (Carbon Capture and Storage), and smart aquaculture industries, Korea can expand its market share and lead global trends. Furthermore, securing core recycling and conversion technologies, along with achieving self-reliance in CCS technologies to secure overseas storage sites, will enable additional profits through domestic conversion demands. Ultimately, Korea aims to become a Total Solution Provider in the offshore plant conversion sector.

The eco-friendly recycling and conversion of offshore plants is a national agenda that goes beyond mere dismantling to achieve carbon neutrality, energy transition, and offshore industry innovation. Through this study, Korea seeks to develop LNG regasification conversion technologies that reduce investment costs by 20–30% compared to conventional FSRUs, while also contributing to power grid development. Moreover, CCS conversion technologies will enable CO₂ storage in depleted oil and gas fields and drive the industrialization of CCS, allowing Korea to lead the global offshore plant conversion market and promote the sustainable growth of future offshore industries.