LEE Jungyup, Green Ship Technology Team

1. Understanding the Mid-Term Measures

1) New Chapter 5 - Regulation on the IMO Net-Zero Framework

(1) Application

- All ships engaged in international voyages of 5,000 GT and above

- Applicability to semi-submersible vessels will be determined after further review

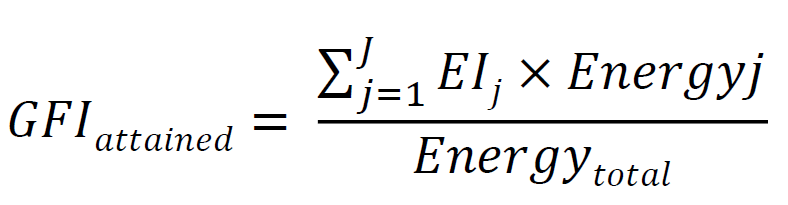

(2) Calculation of GFI (gCO2eq/MJ)

| j : Fuel or energy source type during the compliance period (based on IMO DCS data) emission sources like shore power, solar, wind), MJ |

(3) GFI Target Calculation

- (GFI Baseline) 93.3 gCO2eq/MJ

(representing the average GFI of international shipping in the year 2008)

- (GFI target) 93.3 gCO2eq/MJ × (1 – Base/Direct reduction rate(%))

(4) Base/Direct Target Reduction Rate

Year | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 |

Base | 4.0% | 6.0% | 8.0% | 12.4% | 16.8% | 21.2% | 25.6% | 30.0% |

Direct | 17.0% | 19.0% | 21.0% | 25.4% | 29.8% | 34.2% | 38.6% | 43.0% |

- Reduction Targets for 2036 - 2040 will be determined by 1 January 2032

- Basic Target for 2040 : 65%

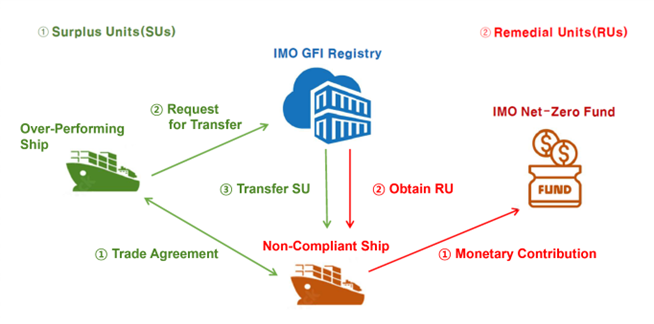

(5) Alternative Compliance Approach

- If the Direct Target is not met, ships must comply through the purchase of RU/SU

- (SU, Surplus Unit) Transferable credit (tCO2eq) obtained by ships that surpass

the Direct Target

- (RU, Remedial Unit) Non-transferable credit (tCO2eq) purchased from the IMO GFI registry

* Alternative Compliance Approach (Refer to Fig.2 below)

Performance Level | Compliance Option | Price |

Above Direct Compliance Targets (Deficit Tier 1) | RU 1 | USD 100/tCO2eq |

Above Base Target (Deficit Tier 2) | RU 2 or SU | USD 380/tCO2eq |

- SU can be used once for only one purpose: Banking, transfer, or voluntary mitigation

* However, different-purpose usage is allowed (e.g., bank -> transfer)

- SU is valid for two years from the issuance date

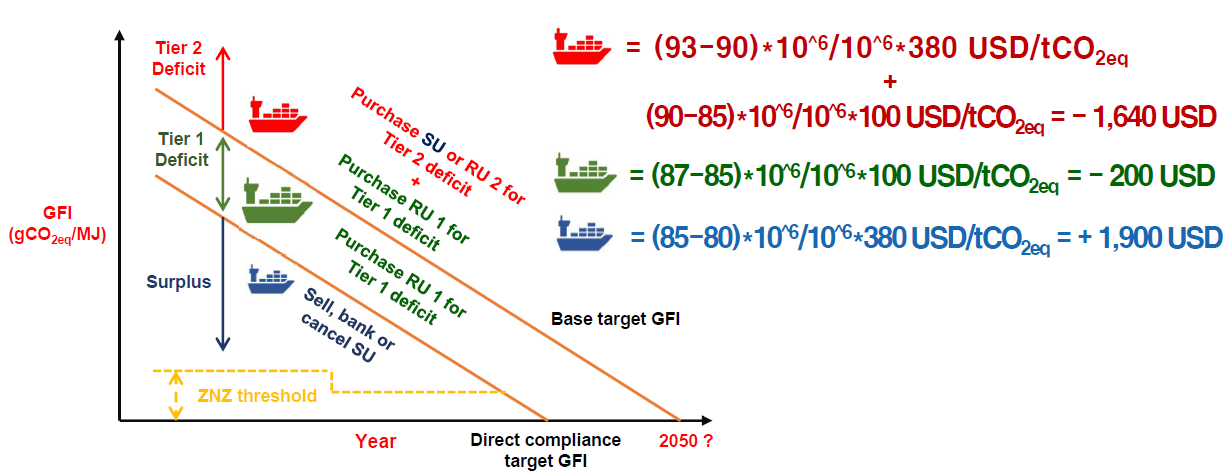

[Example Case]

• Annual energy consumption = 1,000,000 MJ  = 93 gCO2eq/MJ

= 93 gCO2eq/MJ

• Base GFI target = 90 gCO2eq/MJ  = 87 gCO2eq/MJ

= 87 gCO2eq/MJ

• Direct GFI target = 85 gCO2eq/MJ  = 80 gCO2eq/MJ

= 80 gCO2eq/MJ

* This has been created for explanatory purposes only.

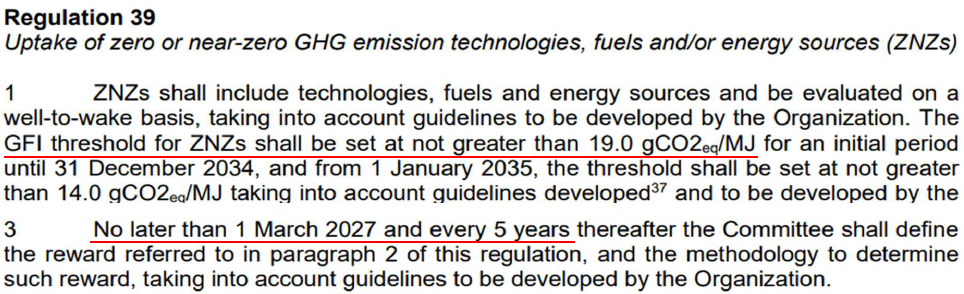

(6) ZNZ(Zero or Near-Zero)

- (Definition) Technologies, fuels, or energy sources with zero or near-zero GHG emissions

- (Threshold) Until the end of 2034 19.0 gCO2eq/MJ From 2035 onward 14.0 gCO2eq/MJ

- Guidelines on the definition of ZNZs, of ZNZs rewards and the methodology to determine

such rewards will be developed by 1 March 2027

(7) Sustainable Fuel Certification Scheme (SFCS)

- (Definition) Certification for fuels that comply with relevant guidelines and regulatory

requirements

- Certified information on the Fuel Lifecycle Label (FLL) should accompany the Bunker Delivery

Note (BDN) upon fuel delivery

- IMO will publish a list of recognized SFCSs by 1 March 2027 and update it every 5 years

(8) Review Clause

- Every 5 years, a review will be conducted on the following:

• Amendment to the annual GFI reduction target

• Amendment to ZNZ threshold value

2. Impact Assessment of Mid-Term Measures

1) Macro-Level Analysis: Global Maritime Sector Cost

- Fuel consumption data(ton) based on 2023 IMO DCS

- GFI by fuel type based on FuelEU Maritime

Fuel Type | HFO | LFO | MGO | LNG | Total |

Fuel Use (t) | 130,441,745 | 40,416,174 | 26,600,016 | 12,890,011 | 210,347,946 |

GHG Emissions (tCO2eq) | 483,912,786 | 151,207,011 | 102,905,353 | 48,290,235 | 786,315,385 |

Energy Use (TJ) | 5,282,891 (60.7%) | 1,657,063 (19.0%) | 1,135,821 (13.0%) | 632,899 (7.3%) | 8,708,674 |

- 2023 Attained GFI of international shipping = 90.29 gCO2eq/MJ

- Estimated Costs (2028–2030) assuming no fuel mix changes

Year | Reduction Rate (%) | GFI Target (gCO2eq/MJ) | RU Cost (million USD) | ||||

Base | Direct | Base | Direct | RU1 | RU2 | Total | |

2028 | 4 | 17 | 89.57 | 77.44 | 10,562.75 | 2,392.81 | 12,955.56 |

2029 | 6 | 19 | 87.70 | 75.57 | 10,562.75 | 8,567.96 | 19,130.71 |

2030 | 8 | 21 | 85.84 | 73.71 | 10,562.75 | 14,743.10 | 25,305.85 |

* RU2 cost may vary depending on SU market price

- RU1 could generate an annual fund of approx. USD 10.56 billion

2) Micro-Level: Individual Ship Regulatory Compliance Cost Analysis (2028)

- Case 2028 GFI

Case | 2028 GFI (gCO2eq/MJ) | Fuel Type | Fuel Use (t) | Energy Use (GJ) | RU Cost (MUSD) | Fuel Cost* (MUSD) | Total Cost (MUSD) | Eligible Emissions for Compensation (tCO2eq) | ||

Target (Direct) | Attained | RU 1 | RU 2 | |||||||

As-is | 77.44 | 91.59 | HFO | 26,990.9 | 1,093,133.2 | 1.34 | 0.85 | 12.68 | 14.87 | - |

VLSFO /MGO | 258.6 | 11,041.7 | ||||||||

B30 | 77.34 | HFO | 10,360.2 | 419,586.5 | - | - | 18.54 | 18.54 | 12,135.1 | |

B30 | 17,415.1 | 684,588.5 | ||||||||

e-fuel | 77.41 | HFO | 22,901.4 | 927,507.0 | - | - | 22.13 | 22.13 | 13,239.3 | |

e-fuel | 8,877.8 | 176,668.0 | ||||||||

* Given the assumption of eligible emissions for compensation defined as 'direct GFI - ZNZ GFI', the amount of reward for use of ZNZ fuels is estimated 300(B30)~550(e-fuel) USD/tCO2eq

3. Regulatory Considerations

1) ZNZs rewards and RU Pricing after 2030

(1) Methodology for ZNZs and Price Levels (to be finalized by 1 March 2027)

(2) RU pricing after 2030 (to be finalized by 1 January 2028)

2) Fuel Price Impacts and Compliance Costs by Fuel Type

(1) Estimated Compliance Cost Increase by Fuel Type

- 91.6-94(HFO), 90.6-94(VLSFO/MGO), 76.3-80(LNG)

|

Source : CIA report_task2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Outlook of E-fuel

- Widespread e-fuel adoption is expected no earlier than 2030, provided that ZNZs reward and post-2030 RU pricing help narrow the price gap between conventional fuels and e-fuels.