Writers

LEE Hyunyong Senior Researcher, KIM Chongmin Senior Researcher

System Safety Research Team

1. Introduction

The shipping sector accounts for approximately 2.89% of global CO2 emissions. Accordingly, the International Maritime Organization (IMO) adopted the Initial IMO GHG Strategy in 2018 with the goal of carbon-free shipping by completely phasing out GHG emissions from the shipping sector in this century. The first target is to cut GHG emissions by 50% by 2050 based on its level in 2008. This Initial IMO Strategy will be confirmed and finalized in 2023. However, several countries, predominantly from Europe, have proposed that net-zero shipping emissions should be achieved by 2050 and not by the end of this century; therefore, further stringent regulation of GHG emissions is expected.

Moreover, the European Union (EU) has pushed for the inclusion of the shipping sector into the Emission Trading Scheme (ETS) by 2024 through “Fit for 55,” a package of legislative proposals, and established the new FuelEU Maritime regulation to mandate the use of sustainable marine fuel. This will likely lead to the implementation of tighter regulations and put increased pressure on the IMO. Apart from the transnational regulations on GHG emissions, such as those of the IMO and EU, shippers, charters, and financial institutions have also established GHG emission limits by imposing penalties for achieving environmental, social, and governance metrics. Consequently, the reduction of shipping emissions is vital for the survival of shipping companies.

To provide useful information for shipping companies, KR jointly published a technical document on ammonia, one of the favored carbon-free fuels, with Seoul National University and the Korea Institute of Energy Research. This technical document analyzes the technical characteristics, risk, mass production possibility, bunkering infrastructure, etc., of ammonia as a marine fuel. The report also performs a relative comparison with other alternative fuels through various information and assumptions that can be predicted in the current situation. Finally, we summarize the contents of the relevant ammonia technical document and introduce it to readers.

Fig. 1 Technical document

2. Technology of Ammonia-Fueled Ships

This chapter introduces the characteristics of ammonia as a fuel, engine development trends of major engine manufacturers, ammonia fuel supply systems, attributes of tanks, and development trends related to ammonia fuel-propelled ships.

2.1 Characteristics of Ammonia

The main characteristics of ammonia as a ship fuel can be summarized as follows.

[Volume] Liquefied ammonia requires about 4.1 times the size of a tank compared to diesel fuel due to its low mass-energy density.

[Ignition/combustion characteristics] The risk of fire is relatively low because the combustible range is narrow, and the conditions for ignition are difficult. Due to these characteristics, ammonia engines require pilot fuel.

[Corrosion] Ammonia is corrosive to some materials, such as copper, copper alloys, and zinc, and this should be considered when selecting these materials.

[Toxicity] Ammonia is a colorless, toxic substance with a pungent odor at ambient temperatures and atmospheric pressure.

2.2 Overview of Ammonia-fueled Engine Development

The most important milestone for the commercialization of Ammonia-Fueled Ships is the development of ammonia engines. Major engine companies such as MAN, Wartsila, WinGD, Hyundai Heavy Industries Group, and STX Engine are developing ammonia engines and are announcing plans to release them after 2024. For details, refer to the technical document.

2.3 Development of International Regulations

At the 105th session of the IMO Maritime Safety Committee held in April 2022, a review of the guidelines about ships using ammonia as an alternative fuel was proposed. As a result of the session, participants agreed that the guidelines on the safety of ammonia-fueled ships must be reviewed by 2023. In this regard, safety measures for ammonia-fueled ships were reviewed at the 8th CCC Sub-Committee conducted in September 2022, and discussions were held on Agenda item 13, which focuses on the development of guidelines for the safety of ships using ammonia as fuel.

3. Ammonia Production and Bunkering

3.1 Overview of Major Clean Ammonia Projects

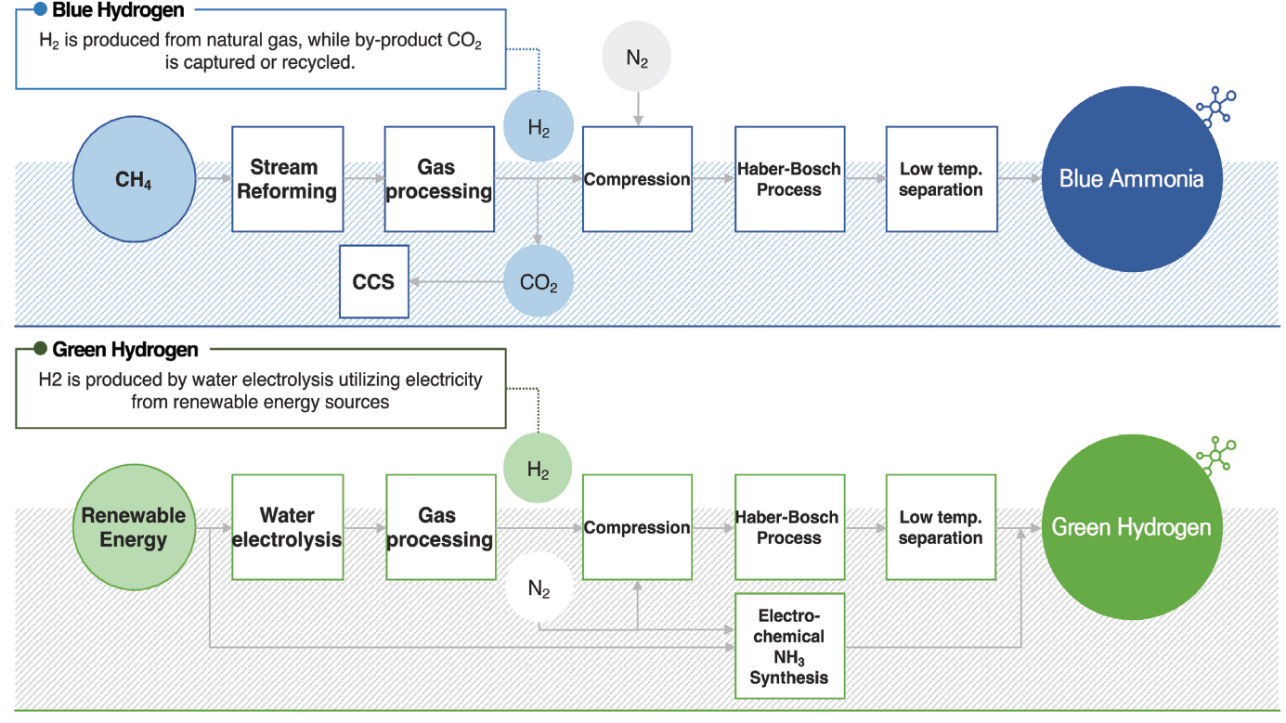

Clean ammonia comprises blue and green ammonia, which refers to ammonia that has been produced with minimal or no CO2 emissions. Green ammonia is produced by supplying green hydrogen generated through water electrolysis using renewable energy to the Haber–Bosch process. Blue ammonia is synthesized using blue hydrogen produced via natural gas steam reforming. The CO2 produced with hydrogen in this method is processed through a carbon capture and storage (CCS) system or used in the utilization process.

Fig. 2 Schematics for process of blue/green ammonia production

(Source : In-depth Investment Analysis Report: Clean Ammonia, Korea Institute of Energy Research)

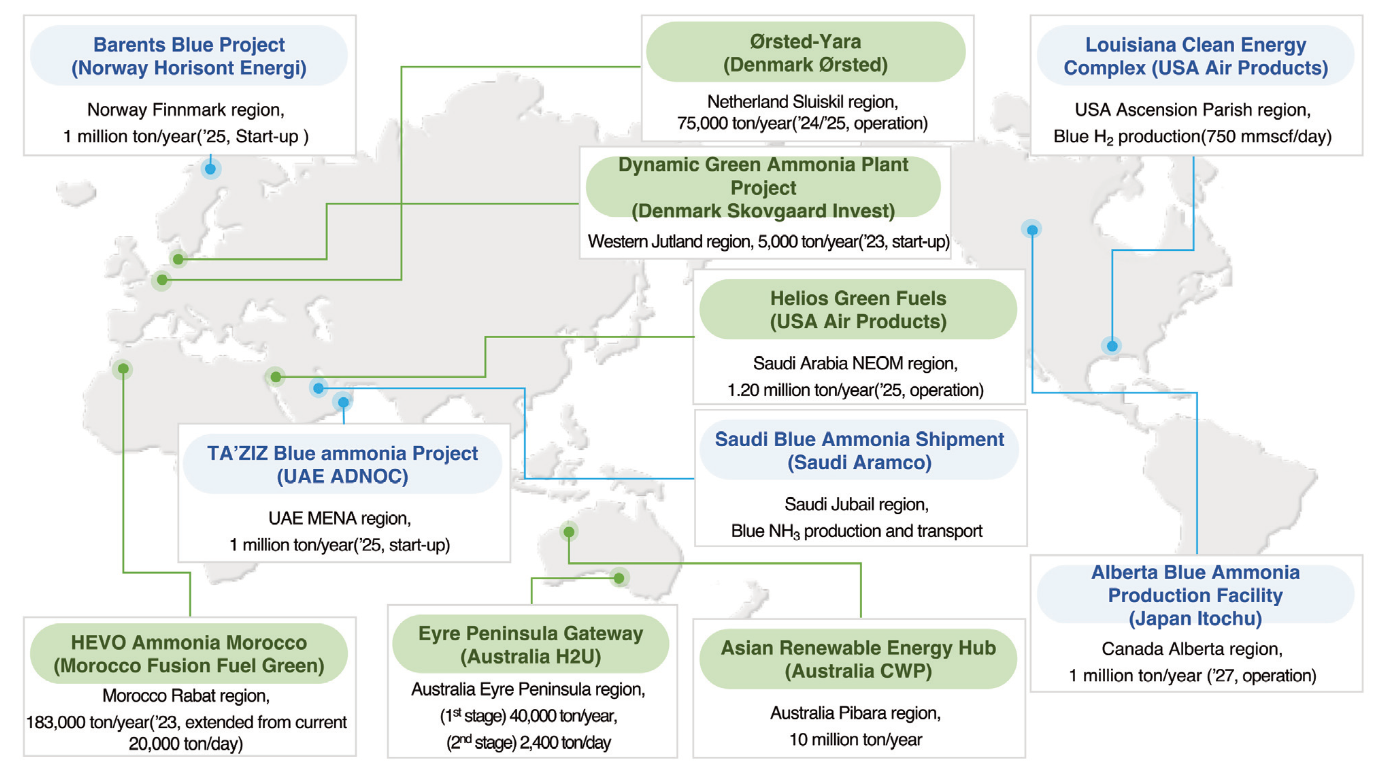

The figure below shows an overview of major ammonia production and transportation projects.

Fig. 3 Overview of major ammonia production and transport projects worldwide

3.2 Overview of the Clean Ammonia Market and Price

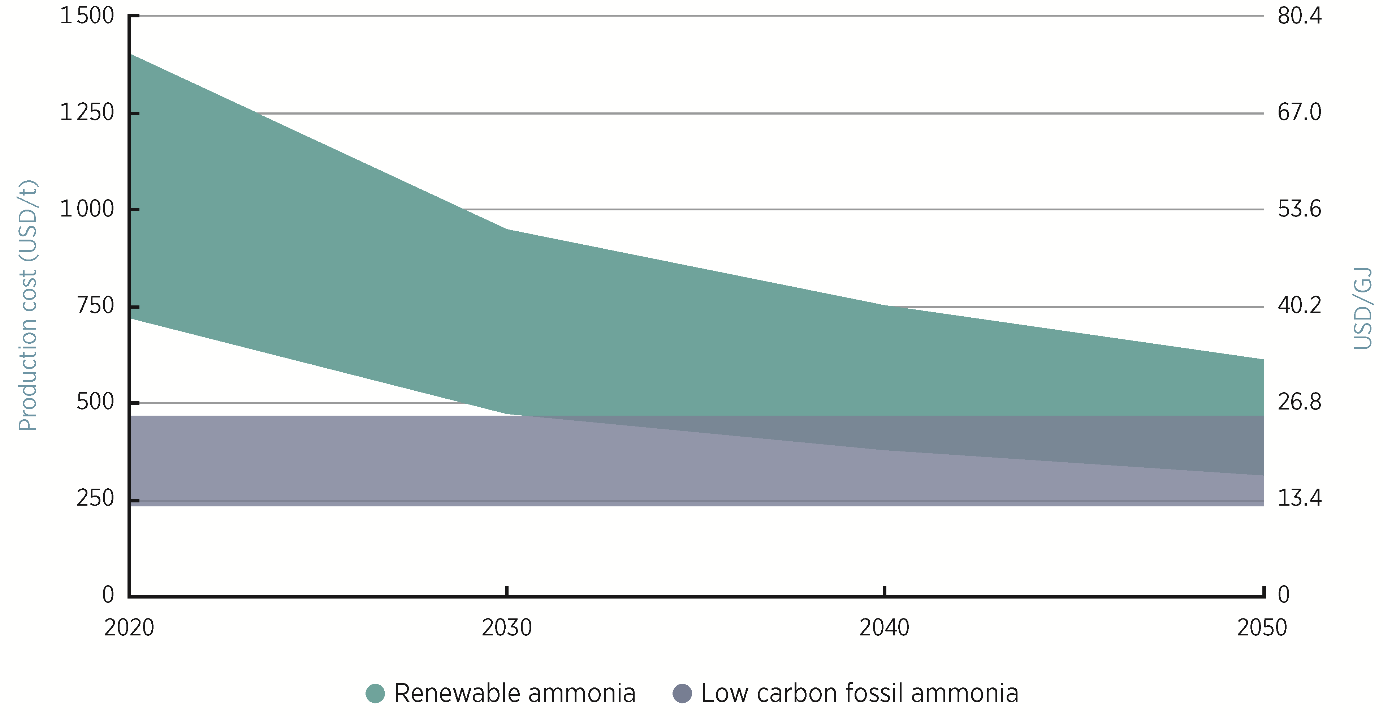

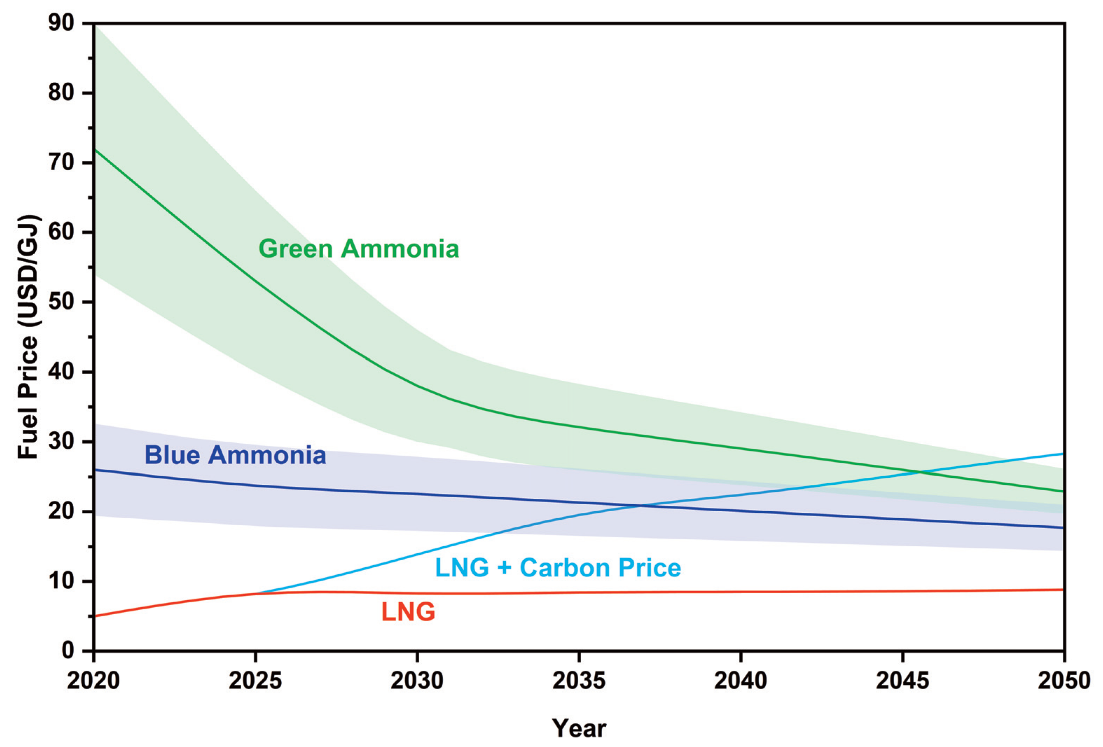

The figure below shows the result of forecasting the changes in the price of green and blue ammonia until 2050. Until 2030, the price of green ammonia is unlikely to be more competitive than that of blue ammonia; however, after 2030, the price of green and blue ammonia will become comparable. Therefore, the prospect of market growth and mass distribution of green ammonia are critical parameters for determining the reduction of the market price.

Fig. 4 Projection of price changes in the future renewable ammonia market

(Source : IRENA, 2022, Innovation Outlook Renewable Ammonia)

3.3 Ammonia Logistics and Bunkering

In the case of ammonia, approximately 180 million tons (MT) of gray ammonia are produced and transported annually, indicating that the necessary port infrastructure is already well-established.. There are 38 export terminals and 88 import terminals in operation worldwide, 6 of which are capable of importing and exporting. In the current distribution patterns, terminals are primarily located around areas with an abundance of natural gas reserves for easily producing and exporting ammonia. The ammonia is transported to places with sufficient demand for chemical fertilizers and raw materials for sale. Therefore, ports for import and export, as well as infrastructure, have already been built around the world. With the increase in projects involving green ammonia production and export, the number of ammonia bunkering ports is expected to increase.

4. Ammonia as a Hydrogen Carrier

In the maritime industry, ammonia is receiving much attention as a ship fuel, but many countries/companies see ammonia as an efficient hydrogen carrier.

Currently, fertilizer production accounts for most of the ammonia demand. However, if ammonia is used as a hydrogen carrier, the infrastructure for mass production will be developed. Subsequently, ammonia is highly likely to position itself as the commonly used marine fuel with reduced price and ease of supply.

Further, with active progress on the clean ammonia production projects and the number of countries that plan to export the produced clean ammonia increasing, the demand for ammonia tankers is expected to rise rapidly.

5. Next-Generation Marine Fuel Outlook

In this chapter, despite the technical and economic uncertainty of ammonia as a marine fuel and uncertain carbon price due to IMO regulations, we collected information that is currently available to predict the price of fuels and carbon tax and present an analysis of the timing of the fuel transition from LNG to ammonia.

The price projection for clean ammonia and LNG, when considering the carbon tax as well as the fuel price, is shown in the figure below. As the price of renewable energy declines in the future, the fuel price of green ammonia is expected to decrease. Conversely, the price of LNG with the application of carbon tax shows a gradually increasing trend. Therefore, the price of blue ammonia will become similar to that of LNG by 2035-2040, and the crossover where the price of green ammonia becomes cheaper than that of LNG will occur in 2042-2048. This indicates that, in the projection, with a continuous decrease in green ammonia production cost due to the increasing carbon tax, the use of ammonia as fuel is more advantageous in terms of fuel price from around 2045.

Fig. 5 Projection of fuel prices: LNG, blue, and green ammonia (Carbon tax applied)

Despite the many advantages of ammonia mentioned above, concerns surrounding technological development such as ammonia engines, safety issues due to the toxicity of ammonia, and uncertainties in the production and bunkering of green/blue ammonia remain challenges to be overcome.

The technical document can be downloaded from the Korean Register website (http://www.krs.co.kr).